How Is Child Support Calculated in Washington?

Going through a separation, divorce, or custody dispute creates stressful situations. Determining how child support is calculated in Washington only adds to that strain.

Parenting plans and support arrangements are complex areas of law and a plethora of issues often arise when resolving them. One facet of child custody that garners a lot of questions is: How does Washington calculate child support?

Before tackling what factors impact support payments, we first need to understand what the term means.

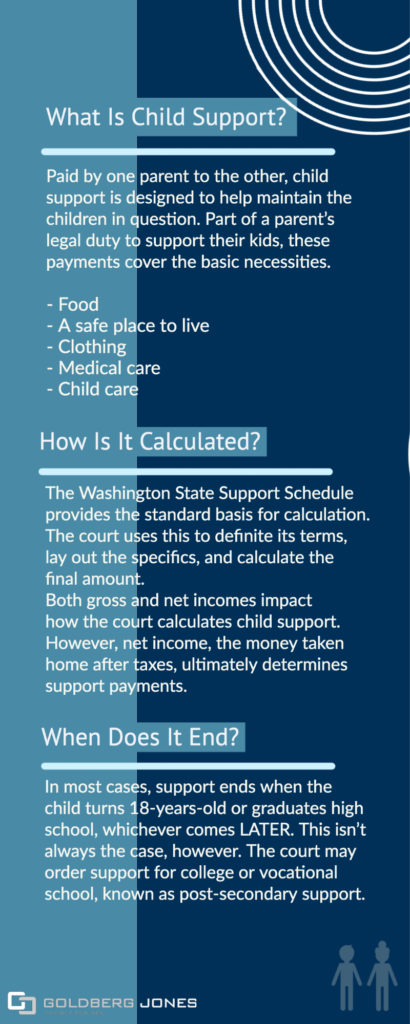

What Is Child Support?

Paid by one parent to the other, child support is designed to help maintain and care for a child. Part of a parent’s legal duty to support their kids, these payments cover the necessities.

Paid by one parent to the other, child support is designed to help maintain and care for a child. Part of a parent’s legal duty to support their kids, these payments cover the necessities.

Child support is often a continuing issue in divorce and child custody cases. Every situation is different, but there is a general formula for calculating the final amount.

This includes providing:

- Food.

- A safe place to live.

- Clothing.

- Medical care.

- Child care.

- Other basic needs.

A parent’s ability to pay also factors into the child support award. The court considers each party’s income and the needs of the children. This amount is called the basic support obligation, usually a monthly payment from the noncustodial parent to the custodial parent.

Related Reading: What Is A Parenting Plan? What’s In It?

How Is Child Support Calculated in Washington?

The Washington State Support Schedule provides the standard basis for child support calculation. The court uses this formula to define its terms, lay out the specifics, and calculate the final amount.

The child’s age plays a significant role. After age 12, the court may modify the amount to account for the added expense of raising a teenager.

Both gross and net incomes impact how the court calculates child support. However, net income, the money taken home after taxes, ultimately determines support payments.

Related Reading: Average Divorce Costs In Washington

What Constitutes Income?

The number the courts look at to calculate support payments is your after-taxes net income. This is also known as your take-home pay.

In addition to wages, the court accounts for:

-

- Tips.

- Bonuses.

- Unemployment and disability benefits.

- Dividends.

- Interest.

- Commissions.

- Public assistance.

- Social Security/pensions.

- Rental income.

- Prize winnings.

They also make allowances for:

-

- Taxes.

- Tax deductions.

- Insurance.

- Union dues.

- Mandatory retirement contributions.

- Funds owed to any other dependents.

Will My New Spouse/Partner’s Income Impact Payments?

While only your income and that of the custodial parent are included in the calculation, the court may account for your overall financial situation.

This is exceedingly rare, but in specific circumstances, the court may consider a new spouse or live-in partner’s income.

What If Payments Don’t Cover All the Expenses?

The basic support obligation may not cover all of the child’s expenses. In some instances, the court may order the parents to share some costs.

When it comes to uninsured medical expenses, insurance premiums, daycare, education, and long-distance transportation, parents often split payments.

How Long Do Payments Last?

In most cases, support obligations end when the child turns 18 or graduates high school, whichever occurs later.

In some circumstances, the court awards post-secondary support. This continues financial support after their 18th birthday or graduation, sharing the financial burden of college or other educational endeavors.

Generally, you must file the petition for post-secondary support prior to the child turning 18 or graduating high school.

In cases where a child can’t mentally or physically care for themselves, the court may also order continuing support. As with post-secondary support, you must also address this ahead of time.

Related Reading: When Does Child Support Go Past 18?

What If I Can’t Afford The Payments?

There are situations where the court may set payments below the basic support obligation. These come with stiff penalties, however, if you don’t pay.

You may qualify for a reduction if:

-

- You fall below the federal poverty line.

- The amount is more than 45% of your after-tax income.

- You support other children.

- If you split custody or have significant visitation.

- You meet other qualifications.

What if you need to modify your support order?

In cases where a parent suffers financial hardship and can’t make support payments, the court may provide recourse to accommodate the circumstances.

Most common of these is the loss of a job. This represents the most frequent reason for a change in economic situation.

The court requires documentation that proves unemployment or a drastic change in income. Otherwise, they assume you will make payments as usual. You’re also expected to actively search for another source of income to keep up with the obligation.

Even if you can show an extreme, long-term income drop, the court often still requires parents to continue making child support payments. Once in place, they’re reluctant to change these orders, so it’s best to ensure you’re comfortable with the payments before anything becomes final.

Related Reading Modifying a Child Support Order

These are just a few of the many questions and issues surrounding child support and how child support is calculated in Washington.

As you see, it can be a complex endeavor and it depends on many factors. In cases like these, you may be best served by hiring an attorney with experience in this field to guide you through. Whatever money you spend now may save you much more down the road.

Related Reading: What Is The Division Of Child Support?

Join Over

400,000

Entrepreneurs getting our weekly newsletter